Tottenham Hotspur stand at a financial inflection point as serious discussions about partial ownership stakes intensify, with the North London club positioned as an attractive proposition for global investors despite valuation discrepancies.

Football finance expert Stefan Borson’s analysis paints Tottenham as a “brilliant platform” for prospective buyers, citing their world-class stadium, London location, and relatively lean wage structure as compelling assets in an increasingly unpredictable football economy.

The club’s openness to minority investment has drawn interest from Qatari consortiums, former Newcastle executive Amanda Staveley, and US-based MSP Sports Capital, with negotiations progressing behind the scenes.

However, the staggering £5 billion price tag attached to Tottenham in recent reports appears ambitious when contrasted with Forbes’ independent valuation of £2.44 billion – nearly half the suggested figure.

This valuation gap reflects the complex dynamics of modern football club acquisitions, where potential buyers must weigh tangible assets against the volatility of sporting success.

The Tottenham Investment Proposition

Borson highlights several unique advantages that make Spurs stand out in a crowded market of potential club investments.

The state-of-the-art Tottenham Hotspur Stadium represents more than just a football ground – it’s a year-round entertainment hub that generates significant non-matchday revenue through NFL games, concerts, and corporate events.

This diversified income stream provides crucial stability in an era where Champions League qualification can no longer be guaranteed, as Manchester United’s recent struggles demonstrate.

The club’s prudent wage management also appeals to investors wary of the financial recklessness plaguing many European rivals.

Tottenham’s salary structure remains sustainable compared to their ‘Big Six’ competitors, offering new owners cleaner financial foundations to build upon.

However, Borson cautions that the lack of guaranteed Champions League revenue – evidenced by Spurs’ own rollercoaster European qualifications in recent years – makes the £5 billion valuation difficult to justify for most serious investors.

The Mbeumo Factor in New Era

On the pitch, Thomas Frank’s appointment as manager could influence both Tottenham’s playing style and transfer strategy. The club reportedly sense an opportunity to hijack Manchester United’s move for Brentford’s Bryan Mbeumo, leveraging their Champions League football and Frank’s existing relationship with the Cameroonian winger.

The 25-year-old’s potential arrival would signal a shift towards targeted, cost-effective signings that maximize the new manager’s strengths – a strategy that could appeal to incoming investors prioritizing sustainable growth over lavish spending.

As Tottenham navigate these parallel tracks of boardroom negotiations and squad rebuilding, the coming weeks could redefine the club’s trajectory.

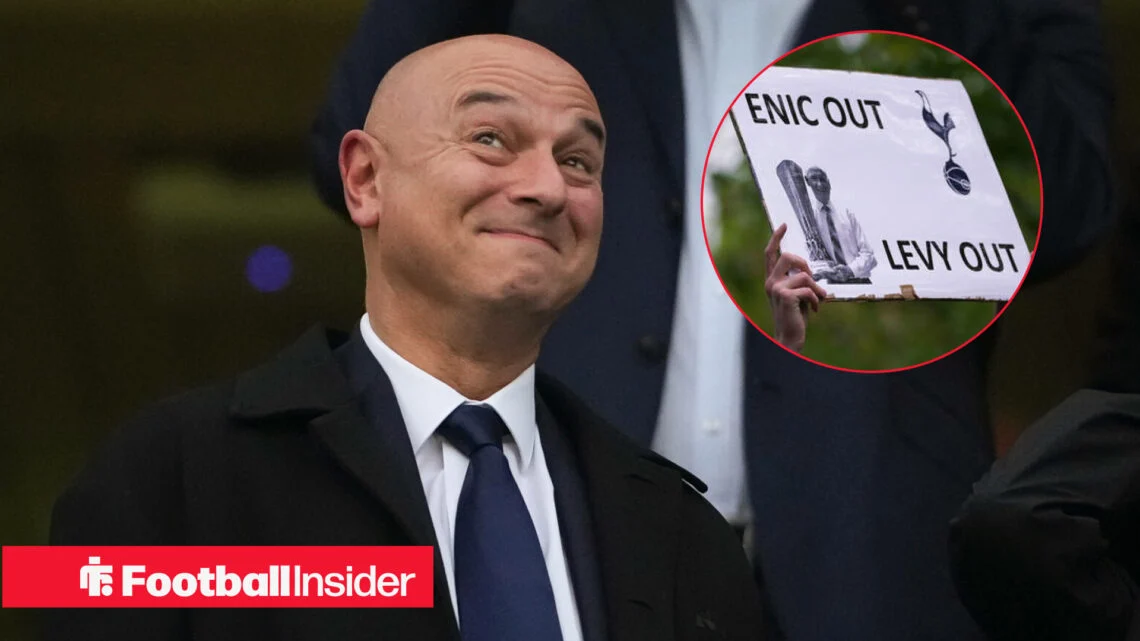

Whether the eventual investment comes from Gulf states, American private equity, or British consortiums, the deal’s structure will reveal much about Daniel Levy’s long-term vision for the club he’s stewarded for over two decades.

One certainty emerges – in an era where financial sustainability becomes as crucial as on-field success, Tottenham’s blend of modern infrastructure and fiscal responsibility makes them one of European football’s most intriguing investment cases.

The resolution of these talks will determine whether Spurs become the latest club to welcome deep-pocketed owners or chart a more measured path to competitiveness.

For potential investors, the appeal is clear: a London-based institution with a globally recognized brand, minimal debt, and room for growth.

But as Borson’s analysis suggests, turning that potential into consistent returns requires navigating football’s new reality – where even historic giants can no longer take elite status for granted.