Daniel Levy remains a divisive figure among Tottenham Hotspur fans, with his football expertise often debated. However, his success as a businessman is beyond question.

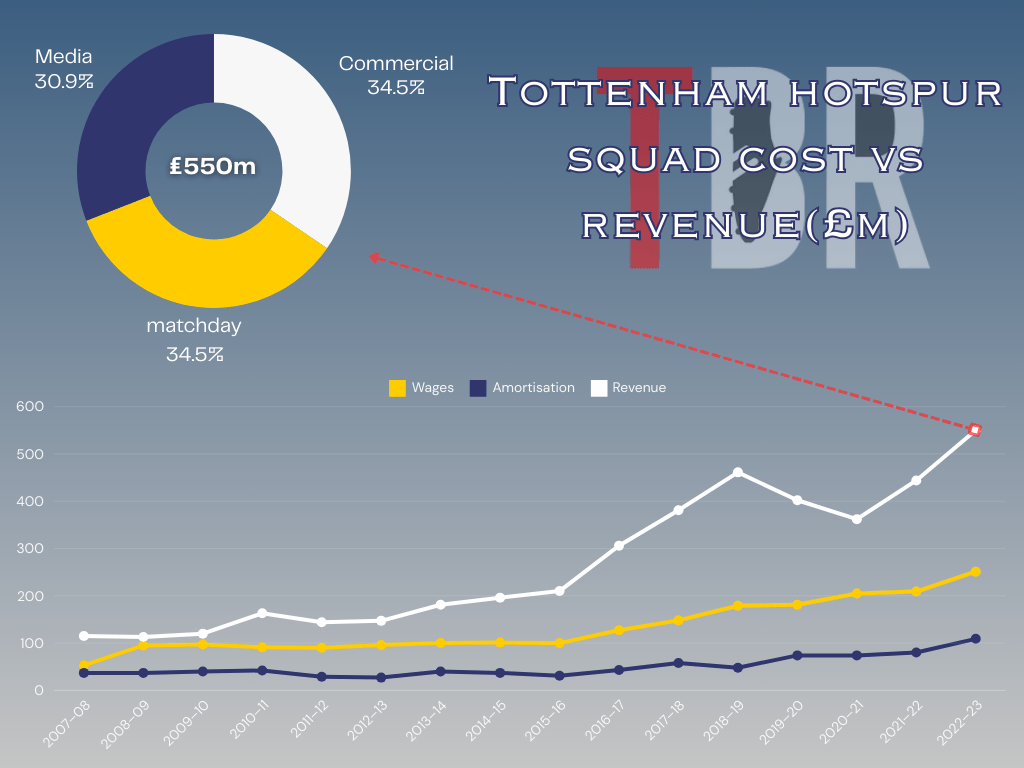

While fans long for silverware—Spurs’ last trophy being the League Cup in 2008—the club’s growth as a commercial powerhouse over the past decade is undeniable. Tottenham has evolved into more than just a football club, becoming a global entertainment brand with a robust portfolio of sponsorships and partnerships.

| Category | Brand |

|---|---|

| Apparel and Merchandise | Nike |

| Financial Services | AIA, Alipay, HSBC, Astropay, BetMGM, Kraken |

| Automotive | INEOS Grenadier, Kumho Tyre |

| Technology and IT | Hewlett Packard, Salesforce, ExpressVPN, SIDIZ |

| Food and Beverages | Coca-Cola, Heineken, Monster Energy, Cadbury |

| Home and Lifestyle | SIDIZ, DEWALT |

| Sports and Performance | Castrol, BP Pulse, SIS |

| Entertainment | EA Sports EAFC |

| Regional and Miscellaneous | Aims, Socios, KNT, Dashing |

Tottenham’s ability to host a variety of events at their state-of-the-art stadium is a testament to this transformation. This season, the club will host more non-football events, such as concerts and sports, than home matches.

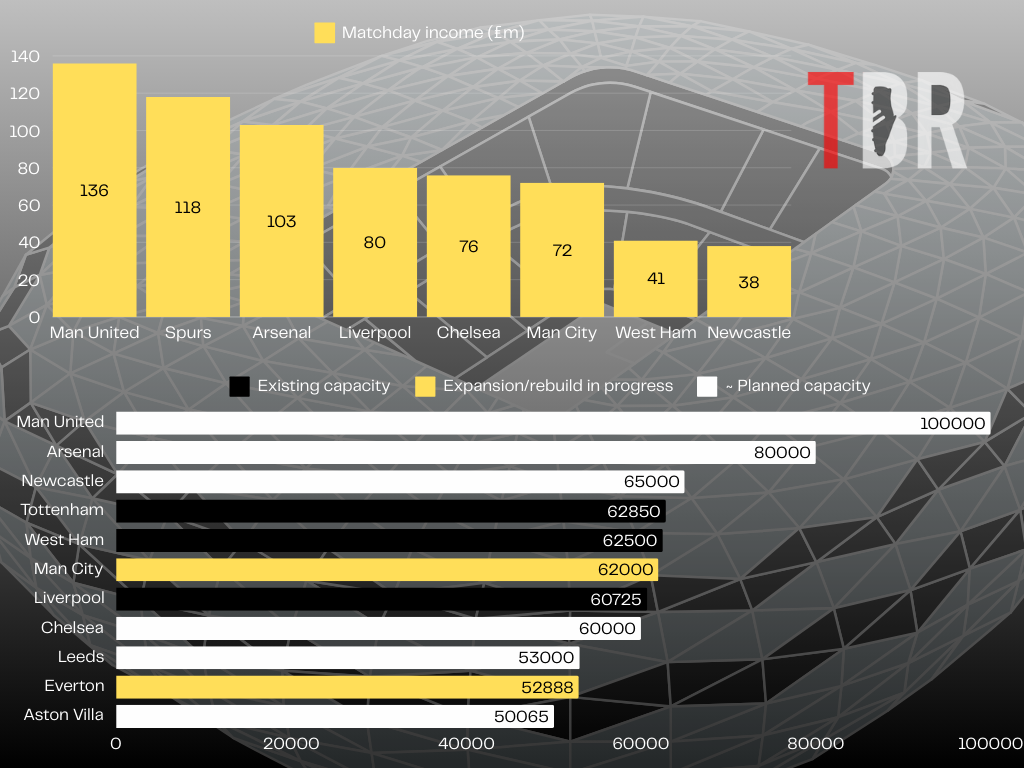

With a recently granted license allowing 30 non-football events annually—up from 16—the stadium is a revenue-generating machine. Last year, Tottenham earned £118 million in matchday income, second only to Manchester United in the Premier League, with only Chelsea earning more per spectator. However, with other top clubs upgrading their stadiums, Spurs understand they cannot afford to remain stagnant.

Matchday income has become a vital component of Tottenham’s financial strategy, even leading to controversial decisions like phasing out concession ticket prices, which sparked fan protests.

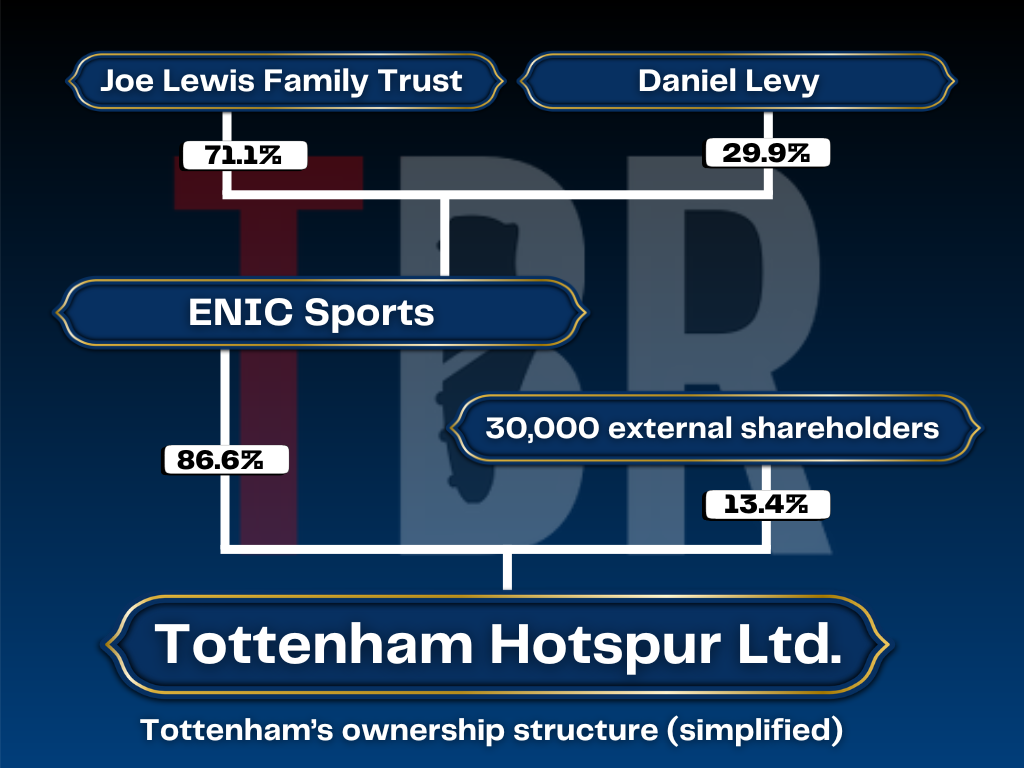

From a business perspective, this move aligns with Levy and ENIC’s strategy to diversify income streams, ensuring financial stability beyond media revenue. In the last financial year, the club’s matchday and commercial income combined nearly tripled its media revenue. This diversification not only enhances the club’s appeal to investors but also reduces reliance on broadcasting deals.

| Revenue Source | Percentage |

|---|---|

| Matchday Income | Significant |

| Commercial Income | Substantial |

| Media Revenue | Relatively Lower |

Levy’s foresight in diversifying revenue could gain further traction with the potential removal of the Saturday 3 p.m. broadcast blackout, a rule in place since the 1950s to protect lower-league attendances.

The Premier League and EFL are reportedly considering lifting this restriction by the 2026-27 season. Spurs chairman Daniel Levy has previously expressed openness to scrapping the blackout, seeing it as an outdated policy.

Removing the embargo could lead to increased broadcasting revenues, benefiting clubs like Tottenham while raising concerns for lower-league teams that depend heavily on matchday income.

As Spurs eye new opportunities to grow their financial strength, the January transfer window raises familiar questions about spending. For football club owners, the primary considerations are whether they can, want to, and are allowed to spend more.

Tottenham’s liquidity—its available cash or assets—is unclear. However, the fact that the club seeks external funding for infrastructure projects suggests a cautious approach to spending.

In terms of Premier League Profit and Sustainability Rules (PSR), Tottenham has substantial headroom, allowing flexibility for transfers. Yet, despite rising wages and amortization expenses, the gap between squad costs and total revenue continues to widen. While some clubs cite PSR as a reason for limited spending, many, including Tottenham, likely use it as a shield for more conservative financial strategies.

| Metric | Trend |

|---|---|

| Squad Cost | Rising |

| Revenue | Increasing |

| Cost-to-Revenue Gap | Growing |

Tottenham’s approach to recruitment and retention under Levy and ENIC emphasizes long-term financial health over short-term spending sprees. As revenue increases, manager Ange Postecoglou and sporting director Johan Lange may see more resources allocated to strengthening the squad.

However, fans should temper expectations for dramatic changes in the January window. While Tottenham has the financial capacity to make strategic investments, the club remains committed to balancing ambition with sustainability, reflecting Levy’s methodical business mindset.