Tottenham Hotspur continues to experience significant changes behind the scenes as another long-time ally of Daniel Levy has left the club, marking yet another step away from the era that defined the North London side for nearly twenty-five years.

While Tottenham are in the process of reshaping their internal structure, Levy’s influence remains embedded within the club’s framework. Having been chairman for decades, his departure doesn’t erase his lasting footprint overnight. Even now, his financial and familial ties keep him connected to Spurs in more ways than one.

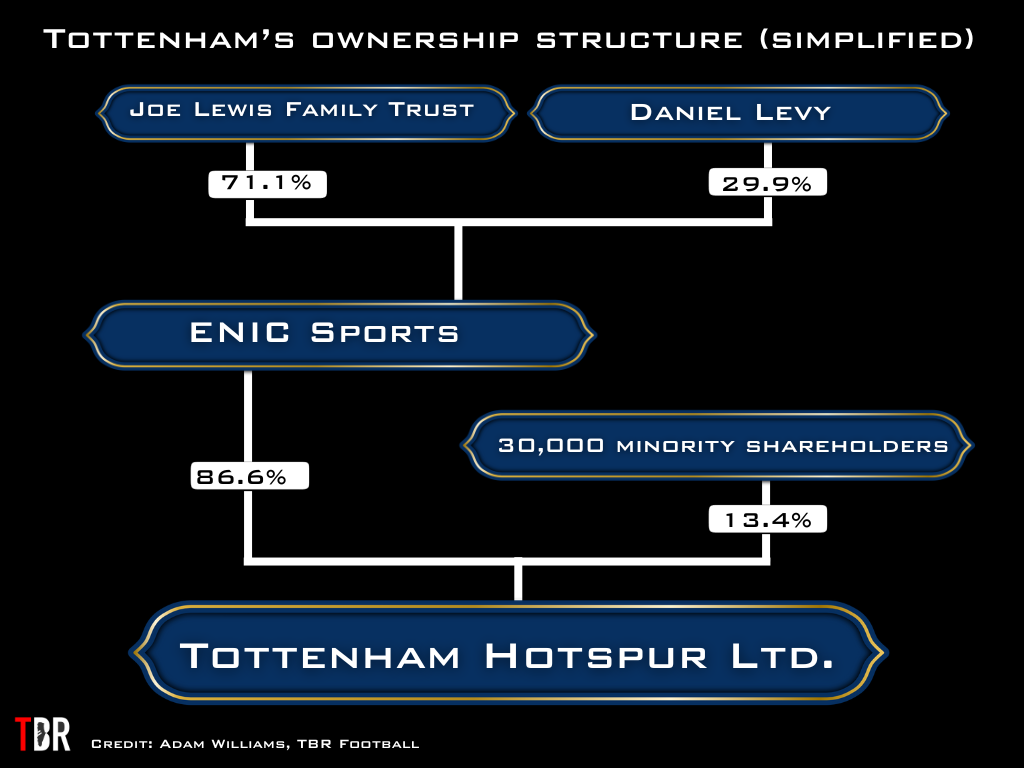

Levy remains a shareholder, owning nearly 30% of ENIC, the Bahamas-based investment group that controls around 85% of Tottenham.

The remaining shares are held by private investors, many of whom bought into the club when it was still listed on the London Stock Exchange decades ago. Some of these shareholders have held their stakes since as far back as 1983.

Should a complete takeover ever occur, the financial return on those early investments would be astronomical, especially with Tottenham’s current estimated enterprise value sitting between £3 billion and £4 billion.

Adding another layer to the Levy legacy, his son Josh Levy serves as co-CEO of Tavistock, the Bahamian entity that oversees Joe Lewis’s various assets, including ENIC’s holding in Tottenham. It’s a reminder that, although Daniel Levy’s day-to-day role is over, the family still maintains a strategic link to the club’s ownership network.

Tottenham’s new direction has already seen considerable boardroom change. Despite ENIC’s recent £100 million cash injection, the funds have been set aside strictly for operational use rather than for any extravagant January transfer spending.

The ownership group also raised eyebrows by taking a £90 million short-term loan from Australian investment firm Macquarie, secured against future Premier League TV revenues. Interestingly, this deal came to light only a week after Levy officially exited his role.

This internal reshuffle followed other notable departures, including Donna-Maria Cullen, one of Levy’s closest associates, who left the club after nearly 20 years of service.

The appointment of former Arsenal executive Vinai Venkatesham earlier this year was widely viewed as the beginning of a new era for Tottenham.

However, insiders suggest that even Venkatesham himself was surprised to learn of Levy’s departure, indicating how swiftly the club’s leadership transition took shape.

Today, Bahamas-based businessman Peter Charrington serves as the club’s non-executive chairman. He is joined by American executive Eric Hinson, who brings decades of experience in the aerospace industry.

More recently, the club confirmed that Rebecca Caplehorn, head of football administration, has also left after ten years of service. Caplehorn’s role was vital, as she often represented Tottenham in meetings concerning football finance and regulation, including those involving the Premier League and the European Club Association now rebranded as European Football Clubs.

Below is the current structure of Tottenham’s new board:

| Position | Name | Background / Information |

|---|---|---|

| Non-Executive Chairman | Peter Charrington | 26 years at Citigroup (Global CEO of Private Banking 2014–2020), Senior Partner at Nexus Luxury Collection, Advisor to One Equity Partners, Board Member at Amey, Acteon, Avaloq AG, Saranac Partners. |

| Chief Executive Officer | Vinai Venkatesham OBE | Former Arsenal CEO, experience with Deloitte and the London 2012 Olympics, served on Wembley Stadium Advisory Board and various UEFA and Premier League committees. |

| Operations and Finance Director | Matthew Collecott | ENIC Group Operations & Finance Director since 1998, ICAEW Fellow, ex-Price Waterhouse, linked with Slavia Prague, AEK Athens, and trustee of the Tottenham Hotspur Foundation. |

| Lead Independent Director | Jonathan Turner | Oxford graduate in PPE, co-founder and ex-President of Qatalyst Partners, over 24 years of experience in global investment banking, advisor to the UK Government on Technology and Finance. |

| Non-Executive Director | Eric Hinson | Former senior executive in aviation and aerospace sectors (Honeywell, Piaggio, Gulfstream), ex-US Navy officer and pilot, leadership experience at SIMCOM International. |

Caplehorn’s exit comes at a particularly delicate time, as Tottenham prepare for key discussions surrounding Profit and Sustainability Rules (PSR) regulations that dictate how clubs manage their spending to ensure financial fairness.

The next Premier League shareholders’ meeting, set for November 21, will focus heavily on these financial rules. Proposed amendments include two major principles anchoring and squad cost control.

Under anchoring, clubs would be limited to spending only five times the revenue earned by the bottom-ranked Premier League club on wages, transfer amortization, and agent fees. The squad cost control rule would cap overall first-team spending at 85% of total turnover, including profits from player sales.

These changes, if adopted, would operate alongside the existing PSR framework and could have a major impact on the league’s financial hierarchy.

Despite the leadership shake-up, football finance expert Kieran Maguire of the University of Liverpool believes Tottenham’s stance on financial discipline is unlikely to change.

Speaking to TBR Football, Maguire noted that Spurs have always maintained a conservative and sustainable financial model, and stricter PSR rules would likely play to their advantage.

“Tottenham are one of the clubs that would be least affected by tighter financial rules,” Maguire explained. “They’ve always operated within their means. Clubs like Chelsea, Manchester City, or Newcastle might view PSR as restrictive, but for Tottenham, it helps preserve their stable position among the elite.”

He went on to say that the PSR debate is also about balancing ambition and control. “For clubs outside the traditional ‘Big Six’ such as Aston Villa, Nottingham Forest, or Everton breaking into that elite group requires heavy investment. Stricter rules make that climb much harder, effectively protecting clubs like Spurs from being overtaken.”

In the wake of Levy’s departure and Caplehorn’s exit, Tottenham find themselves at a crossroads. A new leadership team is in place, guided by experienced figures from finance, aviation, and sport, but the club’s identity remains closely tied to Levy’s two-decade reign.

While ENIC and the new board promote a vision of renewal and modern governance, the coming months particularly with the PSR vote on the horizon will test whether Tottenham truly embrace change or continue to operate in the image of the man who shaped them for so long.